A price collapse that sunk oil into negative territory for May and dwindling storage capacity could halt Louisiana's oil and gas production, warns the Louisiana Oil and Gas Association.

Much of the drop into negative territory was chalked up to technical reasons — the May delivery contract is close to expiring so it was seeing less trading volume, which can exacerbate swings. But prices for deliveries even further into the future, which were seeing larger trading volumes, also plunged. Demand for oil has collapsed so much due to the coronavirus pandemic that facilities for storing crude are nearly full.

Benchmark U.S. crude oil for June delivery, which shows a more ”normal” price, fell 14.8% to $21.32 per barrel, as factories and automobiles around the world remain idled. Big oil producers have announced cutbacks in production in hopes of better balancing supplies with demand, but many analysts say it’s not enough.

A glut of oil has built up because of the global economic slowdown caused by the coronavirus pandemic and reduced demand for gasoline and jet fuel, as consumers stay home and airplanes are largely grounded.

The price of crude oil futures for May dropped to $10.63 on Monday morning then was hovering around $2 before plunging into negative territory and bouncing to a nickle.

The price had not dropped to single digits since 1973. Crude oil prices already had declined by more than 80% since the beginning of the year.

Louisiana's nonfarm employment dropped by 20,300 jobs for the 12 months ending in March as the coronavirus pandemic starting taking a toll on …

Oil prices were predicted to get a boost after OPEC and other oil producers agreed to cut production by nearly 10 million barrels per day, about a tenth of global supply, starting on May 1. But it's unclear whether that is enough to change the market.

Statewide Louisiana lost 1,100 jobs in mining and logging over the past 12 months through March, a decline of 2.9% to 35,600 jobs.

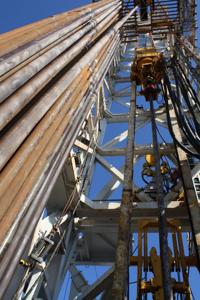

About 450 members of the Louisiana Oil and Gas Association surveyed in recent weeks estimated that about half of the wells in the state could be shut in as a result of the economic downturn. There are 33,650 oil and gas wells operating in Louisiana. But there is only 41 active oil and gas rigs operating across the state including 24 on land and the remainder in the Gulf of Mexico, according to Baker Hughes data as of April 17.

Oil prices got a brief boost following the decision by OPEC and other oil producers over the weekend to cut production by nearly 10 million ba…

Now the situation is more dire.

“Many of our members are being told they cannot deliver crude in May due to storage constraints, and as a result have begun planning to shut in 100% of their Louisiana production,” said Gifford Briggs, president of the Louisiana Oil and Gas Association in a news release. “It’s an absolute worst case scenario."

The trade organization has lobbied for severance tax and royalty payment relief during the crisis and is pushing to loosen restrictions of businesses to restart the economy.

The Strategic Petroleum Reserve, which holds about 635 million barrels of oil, was expected to be filled with an additional 77 million barrels of oil - largely from independent U.S. oil and gas production businesses but the money was not allocated for the purchase. Instead, in mid-April the federal government was negotiating for about 23 million barrels of crude oil storage in the reserve to be rented by several different companies and were slated to be delivered in May and June.

The working storage capacity for crude oil at tank farms and refineries totaled 653 million barrels, according to the Energy Information Administration. About 370 million barrels of which is stored along the Gulf Coast which is about 55% utilized as of April 10. Storage tanks are projected to hit capacity in the next three weeks, according to S&P Global Platts research.

A survey of Louisiana oil and gas business found more than 23,000 jobs in the industry are at immediate risk because of the back-to-back blows…

If you have questions about coronavirus, please email our newsroom at online@theadvocate.com.

Success! An email has been sent with a link to confirm list signup.

Error! There was an error processing your request.