This report has been produced with High Dividend Opportunities author Julian Lin.

Master Limited Partnerships (‘MLPs’) are an asset class which we frequently write about and for good reason: their enticing combination of predictably high distributions and steady cash flows make them important income generators for any dividend portfolio. We believe that valuations for MLPs are very attractive and this coupled with a strong outlook may lead to strong returns moving forward. We are recommending shares of ETRACS 2xMonthly Leveraged Alerian MLP Infrastructure Index ETN Series B (MLPQ) which is an exchange traded note (‘ETN’) tracking the return of 2 times the Alerian MLP Infrastructure Index (AMLP) - or tracking AMLP at 200%. We believe that shares have the potential to provide strong capital appreciation in addition to a high level of income.

Introduction To MLPs

MLPs historically have fulfilled an important niche in investment portfolios. Because their businesses act essentially like a “toll road,” charging customers such as oil producers a fee for using their pipeline infrastructure for transportation of their refined products, MLPs had their earnings see less correlation risk with the price of oil than typical oil stocks. The idea is that the demand for oil will still be there regardless of the price - and thus will see much less volatility than the price of oil. At the same time, because they typically pay a high proportion of cash flow as distributions to common shareholders, they have earned the love of investors seeking dividend, especially those looking for a steady and growing dividend income stream.

Ridiculously Low Valuations - Same as when the Oil Price was at $30/Barrel

That said, MLPs prices can have some correlation to the price of oil: For example when oil prices rise producers increase production to maximize profits, and when oil prices drop producers are less motivated to produce oil.

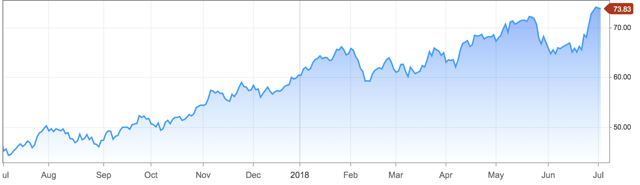

Today the oil price has reached over $73/barrel, and the vast majority of the new oil production is coming from the United States.

It is very surprising to see that while both oil price and oil production have risen dramatically the past year, Midstream MLPs have not only failed to follow through, but have also seen their multiples compress.

Very Attractive Sector Valuations

This has led to MLPs becoming attractive based on several historical valuation comparisons.

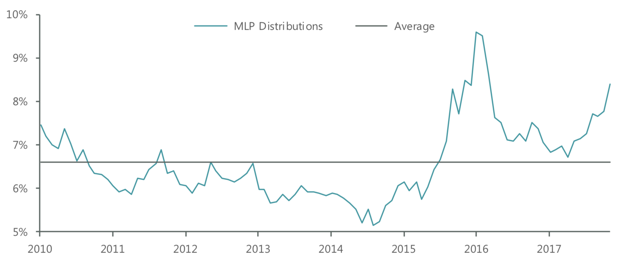

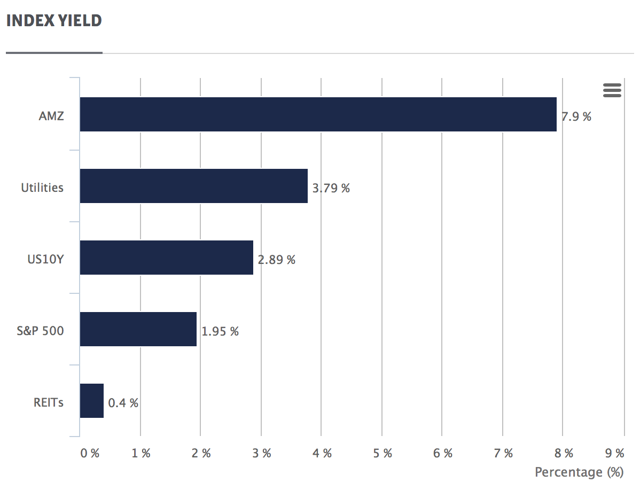

At 7.9%, the average MLP distribution yield is much higher than the average since 2010:

(Pieces in Place for MLP Rebound in 2018)

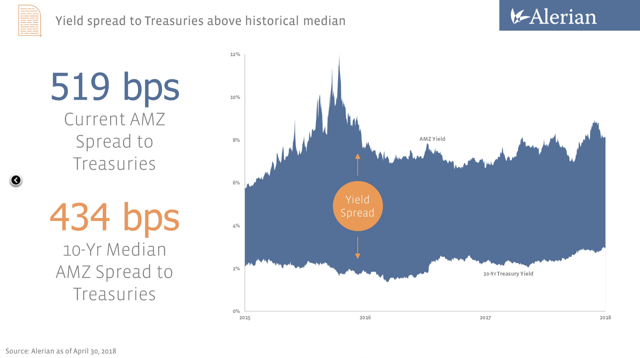

AMLP currently trades at a spread of 5.0% versus 10 year U.S. Treasuries.

This is much higher than the historical spread of 4.34%:

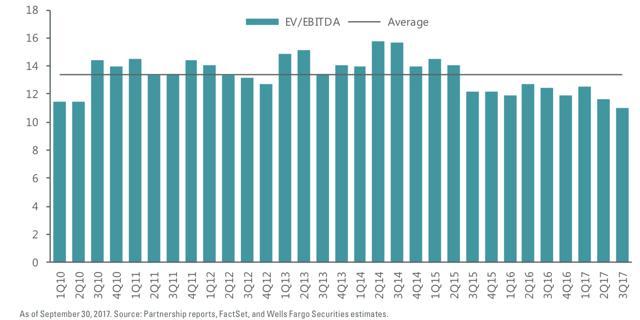

We can see that MLPs at 10.2 times EBITDA are also greatly undervalued based on historical EV/EBITDA multiples:

(Pieces in Place for MLP Rebound in 2018)

The tale of the tape says it all - MLPs now see their shares priced near the lows when the price of oil dropped below $30 per barrel in early 2016:

But Outlook Is Strong

As we saw above, valuations for MLPs reflect extreme pessimism. That said, the fundamentals suggest exactly the opposite.

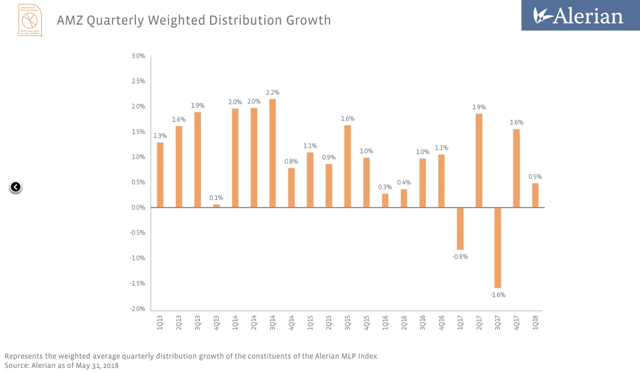

While there have been some distribution cuts in recent quarters, for the most part distributions for the sector have continued to trend higher:

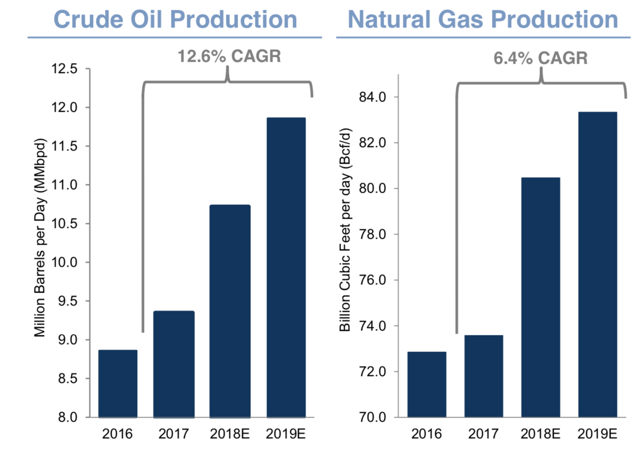

Production for crude oil and natural gas (the two biggest industries for MLPs) are projected to continue to soar higher due to increased demand:

(Goldman Sachs Opportunities Income Fund)

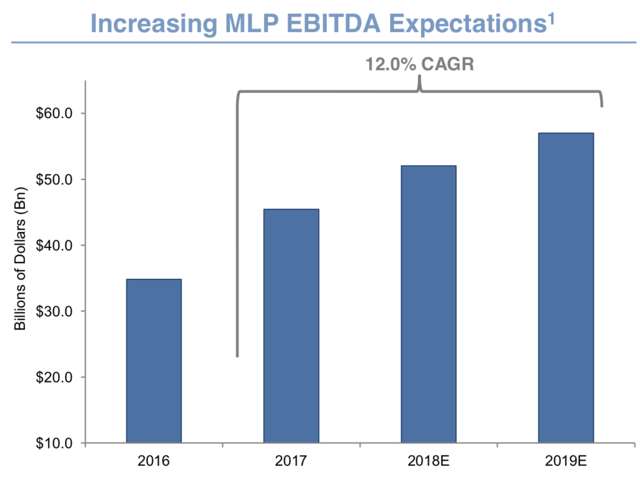

Increased production must lead to increased utilization of pipelines as these products must be transported to their final destinations. This in turn is expected to lead to strong EBITDA growth - 12% compound annual growth rate :

(Goldman Sachs Opportunities Income Fund)

The is a very high growth rate compared to any other sector!

The high expectations stem from anticipation that oil prices can not only sustain current prices but may even have the ability to roar higher. For one, Washington has recently proposed sanctions on Iran which are slated to begin in November. Iran is one of the largest exporters of oil in the world with about 2.2 million barrels per day in the past month, so such sanctions would do more than just move the needle.

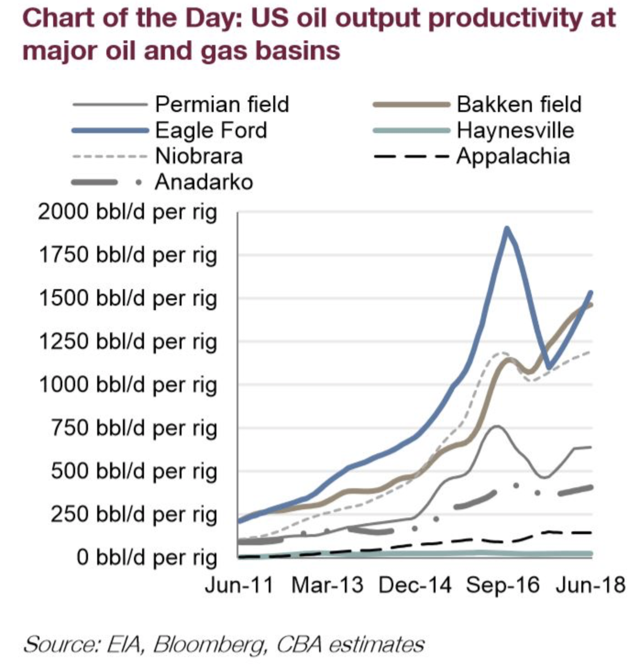

This leaves the shortfall in oil production to both OPEC and the United States to make up for the drop in production, but here we are very optimistic given that OPEC only agreed to modest production increases recently. So most of the production increases will continue to be sourced in the United States. Oil production continues to grow at a phenomenal rate especially at Eagle Ford, the Permian, and Bakken:

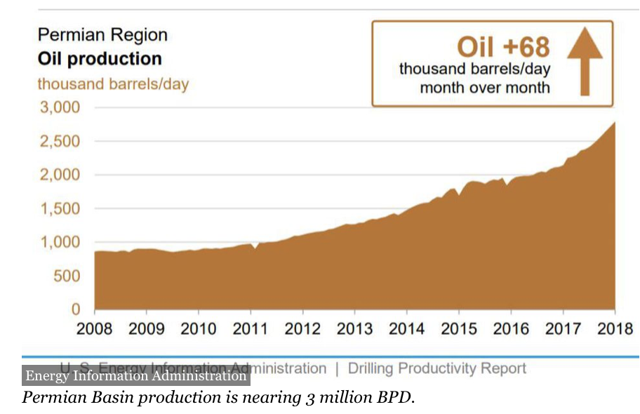

The problem here is that there is so much production that the demand for additional MLP infrastructure has skyrocketed, especially in the Permian basin.

In fact, in the Permian alone, we are seeing record production in its entire 100 years of production:

This is more than what the current infrastructure can handle. This has also affected the natural gas market, as there aren’t enough pipelines to transport natural gas away from the Permian, prices there have dropped significantly. While there are indeed projects to help transport roughly 8 Bcf/d of natural gas from the area, more demand for pipelines is likely to be seen as Permian natural gas production is projected to reach up to 20 Bcf/d in a few years.

While this “bottleneck” may prove stressful for producers, this has created the perfect environment for MLPs. All this increased demand means that midstream pipelines will be running near capacity, and this of course opens the door for very profitable growth projects moving forward.

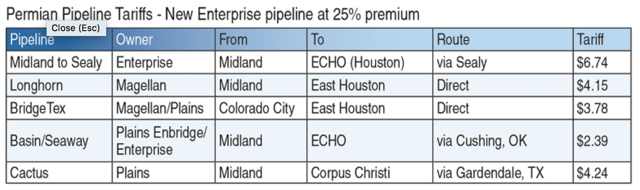

Case in point: when Enterprise Product Partners’ (EPD) pipeline from Midland to Sealy came online they were able to charge 25% premiums to market tariffs:

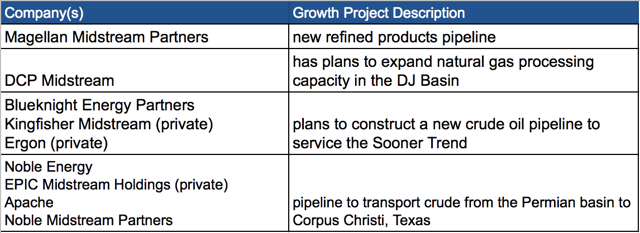

According to Oppenheimer Funds, there were a number of additional growth projects announced in May by MLPs:

Reasons For The Valuation Disconnect

The most important development in recent months may have been the policy change back in March 2018 that the Federal Energy Regulatory Commission (‘FERC’) would no longer allow interstate pipelines organized as MLPs to recover income tax allowances in cost of service rates. The issue raised by the FERC was whether income taxes paid somewhere in the system can be taken into account in calculating rate of return for rate regulated pipelines. For MLPs the taxes are paid by unit holders and so the argument of the FERC was at the time that the MLP itself shouldn't be able to deduct the cost of the taxes.

This announcement alone sent the MLP sector falling as much as 10% that very same day before closing down almost 5%. After MLPs began to give statements as to the impact to projected 2018 EBITDA, it was clear that the fears were overblown. In fact, according to the latest monthly report of the Goldman Sachs Opportunities Income Fund (GMZ), the impact of the FERC decision will only reduce EBITDA by 2.4% for the sector in 2018 (using a weighted average method).

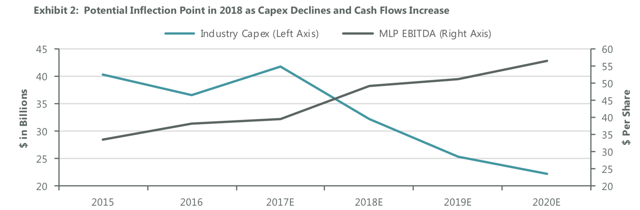

There may also be fears that due to the depressed equity valuations, many MLPs may see a higher cost of capital. To this effort, many MLPs have made commitments towards an end goal of being able to self-fund growth projects without equity issuance. This is reflected in a lower amount of projected capital expenditure expense in relation to EBITDA moving forward:

(Pieces in Place for MLP Rebound in 2018)

Therefore going forward, debt levels will be significantly reduced for the sector.

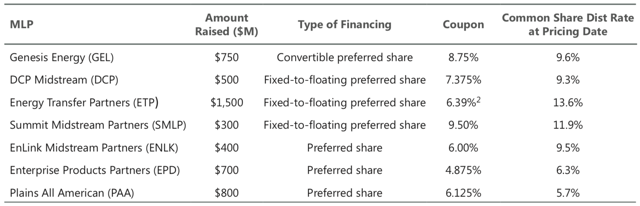

Furthermore, instead of secondary offerings many MLPs have also been utilizing preferred shares as an alternative source of capital which still provide competitive costs of capital:

(Pieces in Place for MLP Rebound in 2018)

Investors with a long term horizon know to never sell equities in panic of what “may happen” and should instead make decisions based on what “will happen.” We view all of the above as short-term headwinds because management teams at MLPs in general have shown the ability to adapt to this changing environment resulting in a degree of resiliency for their companies.

MLPs continue to see strong demand for their pipelines and this combined with historically attractive valuations lead us to pound the table and call a bottom on MLPs.

Great News for the Midstream Sector!

As a result, the midstream sector took a big hit in March 2018 due to the uncertainty and potential loss of revenues resulting from this ruling. It also contributed to a continued weakness in the sector, despite oil price rallying significantly since March 2018 from $59/barrel to over $70/barrel.

Update on the Ruling

The FERC issued its final ruling last week saying that it will simply reduce the rate used in calculating taxes from 35% to 22% rather than disallow any deduction altogether. This is a big change and a big positive for MLPs.

The new rule limits the effect of the limitation on deductions and will boost income for some midstream MLPs. What is also important to note is that the provision that pipelines operating under negotiated rates (almost all of them do - very few rate filings actually lead to hearings and rulings) do not have to change anything at this time. It is also important that pipelines earning 12% return on equity or less do not have to take action and will not have a new rate case filed by FERC.

As a result, for all pipelines the net effect of the change in the FERC ruling will be much less than previously expected, and for most pipelines, there will be no short-term effect whatsoever. So we expect that the weakness seen since March 2018 to start reversing. This is very bullish for the Midstream Sector!

How We Prefer To Invest In The MLP Recovery

When we have such high conviction on a sector, we find it appropriate to “up the ante” by investing with a bit of leverage. MLPQ is an ETN which allows us to do just that, as it seeks to track the performance of 2 times that of AMLP. This means that it is also passively managed.

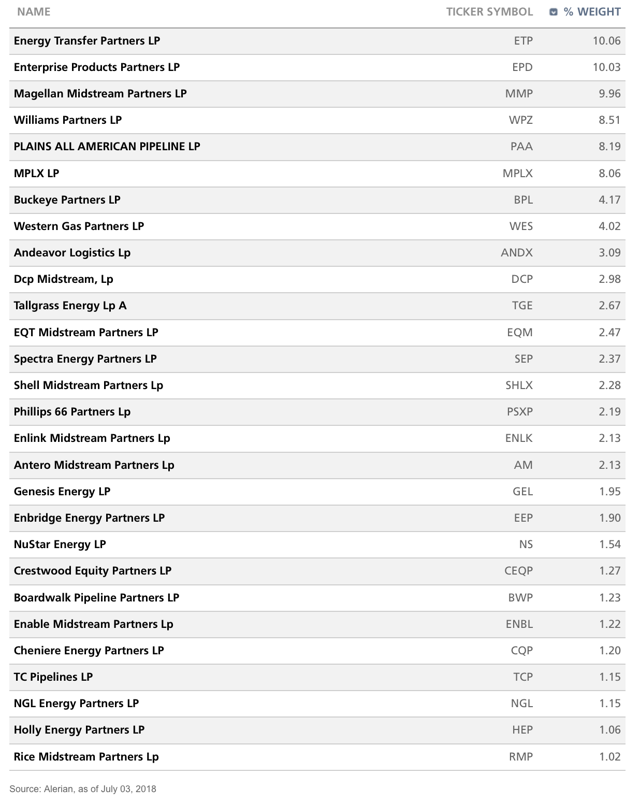

Below we can see the full portfolio holdings of MLPQ:

The Top Five

- Energy Transfer Partners (ETP) is a name which we have been bullish on for a very long time since June of last year. We wrote about this name just last month and believe that it is just dirt cheap in spite of the fact that many of its growth projects are just now coming online.

- Enterprise Product Partners (EPD) is a blue chip MLP which we have also been and continue to recommend. EPD focuses on natural gas and is well capitalized with one of the best balance sheets in the industry with a BBB+ investment grade rating.

- Magellan Midstream Partners (MMP) is the other main blue chip MLP in the space which mainly transports refined products and crude oil. MMP also has a very strong balance sheet with a BBB+ investment grade rating.

- Williams Partners (WPZ) currently is being pursued by its general partner Williams Companies (WMB). It is worth to note that WPZ's profitability was projected to be negatively impacted by the FERC initial ruling in March 2018 to the tune of around $150 million per year in "distributable cash flow". WPZ is set to see a strong recovery after the FERC's final ruling last week.

- Plains All American (PAA) is a former industry darling which after seeing its stock plummet due to excessive leverage, has committed to a disciplined deleveraging program. Furthermore, PAA has a very strong position in the aforementioned Permian Basin.

The 15.4% Yield

MLPQ's pays distributions on a quarterly basis, but investors should note that they can be lumpy and vary from quarter to quarter. This is because the ETN pays its distributions "as they are received" from the underlying index. UBS lists the distribution yield on their website based on the last quarter paid and annualizing it. However, to have a more accurate figure on the yield, let us look at the distributions paid during 2018.

Therefore using a distribution of $3.7930 for the past 9 months results in a yield of 15.4% annualized.

More About MLPQ

- MLPQ has a 0.8% expense ratio, and according to its prospectus supplement, its financing rate is 0.8% plus 3-month LIBOR, which currently is about 2.33%. The low financing costs are a big advantage as this is much lower than what the typical retail investor would be able to attain through most brokers.

- Investors should be aware of the nature of exchange traded notes (ETNs). ETNs are simply notes issued by banks. In the case of MLPQ, investors are taking the credit risk of UBS Bank which is one of the most solid global banks with a very high credit rating.

- MLPQ is twice leveraged and invests in a sector which has historically been volatile. Therefore, MLPQ is not for everyone. Low-risk investors are better off getting exposure to the non-leveraged ETF AMLP which gives the same exposure.

- Although MLPQ seems to be risky because it is twice leveraged, the risks are mitigated by the fact that the ETN is highly diversified into 29 different companies. The risks are further reduced because the sector is trading at attractive valuations.

- MLPQ seems to have a low daily volume, but like the vast majority of UBS products, there are always market makers with a bid and ask price which reflect the product's book value. MLPQ almost always trades at book value which is the value of its underlying securities.

- Most of the leveraged products (ETNs and ETFs) that are available in the markets are reset on a daily basis and are meant for daily or short-term trading. These ETNs can carry an extensive level of risk if held over an extended period of time because the gains and losses are magnified due to the daily reset mechanism and leverage slippage. Unlike these leveraged products, MLPQ is reset on a monthly basis, and therefore there is little or no "magnification effect" (including leverage slippage) over the longer term. MLPQ was designed by UBS to be held as a long-term investment rather than a short-term trading vehicle.

Advantages of investing in MLPQ

- Unlike its MLP constituents, MLPQ does not distribute any K-1 forms, which is a clear advantage come tax season. US investors get the distribution payments taxed as ordinary income and totally avoiding K-1 taxes.

- A good point to note is that MLPQ does not pay any "Return of Capital" ('ROC'). It only pays investors what it receives from its underlying index components, and therefore there are never any destructive returns.

- MLPQ also gives the investor a diversified exposure to the entire sector. There is a tendency for asset managers to experience ups and downs in performance and this may lead large investors to shift funds to "hot" asset managers. By investing in the entire sector, the danger of "betting on the wrong horse" is eliminated. The 2X leverage amplifies the upside (but can also amplify the downside).

30% Upside Potential - Not Counting Growth

As noted above, the sector is currently trading at very attractive valuations, with a spread of 5.0% versus 10 year U.S. Treasuries, versus a historical spread of 4.34%. This is despite a strong growth and a very solid outlook. We believe it will not be long before the sector starts trading at around its historical valuations which would give MLPQ an upside potential of 30% without factoring in any growth, which is estimated at 12% compound annual growth rate. This is also without taking into account the generous 15.4% yield.

Bottom Line

The bull case for MLPs is as strong as it has been in several years as valuations remain near cycle lows. After 4 years of deleveraging, de-risking of operations and moving toward self-funding of capital expenditures, the sector is in its best financial shape since the boom times. It is also a great place to be invested with growth picking up in the US shale business. This is a table pounding recommendation to load up. MLPQ is an attractive way to gain exposure to the sector, for which investors are paid 15.4% to wait for prices to reflect the true underlying value of their earnings. Both final ruling from the FERC and strong earnings results that we are set to see in Q2 2018 should provide the tailwind for a strong sector recovery. At High Dividend Opportunities, we extensively cover the midstream sector, and continuously provide our investors with a list of the best buys in this space.

If you enjoyed this article and wishto receive updates on our latest research, click "Follow" next to my name at the top of this article.

Note: All images/tables above were extracted from the Company's website, unless otherwise stated.

About "High Dividend Opportunities"

High Dividend Opportunities is a leading and comprehensive dividend service ranked #1 on Seeking Alpha, dedicated to high-yield securities trading at bargain valuations. It includes an actively managed portfolio currently yielding 9.7% - with a selection of the best high-yield MLPs, BDCs, Property REITs, Preferred Shares, CEFs and ETFs. Subscribers benefit from "Live Alerts" to buy securities at attractive prices. We invite income seekers for a 2-week free trial to help you identify the future out-performers in the high yield space. For more info, click HERE.

Disclosure:I am/we are long MLPQ, EPD, ETP.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.